A construction loan can be your best ally when building your dream home from scratch. Unlike traditional mortgages, construction loans are designed to cover the costs of building a new home or major renovation projects. This article will explore the ins and outs of new construction loans, how they work, and how to secure one for your home construction loan project.

Understanding Construction Loans

What is a construction loan? It is a short-term, high-interest loan used to fund the construction of a new home or major renovation projects. Unlike regular home loans, construction loans cover the costs of land, labor, materials, and permits required for construction lending. These loans are typically offered for one year and are meant to be paid off once the construction is complete.

If you’re planning a complete build or large-scale remodel, understanding your financing options is just as important as knowing how to calculate material estimates for accurate construction planning.

How Do Construction Loans Work?

How do you get a construction loan? How do construction loans work? It works differently from traditional home loans. Instead of receiving a lump sum upfront, borrowers get the loan in stages as the construction progresses. The gradual release of funds is referred to as a draw schedule, where money is distributed upon completing designated stages in the construction process.

For example, initial funds might be released to cover land purchase and initial site preparation. Other disbursements would then cover the foundation, framing, plumbing, electrical work, and finishing touches, hence ensuring that funds are available when needed while keeping borrowers accountable for each stage of construction.

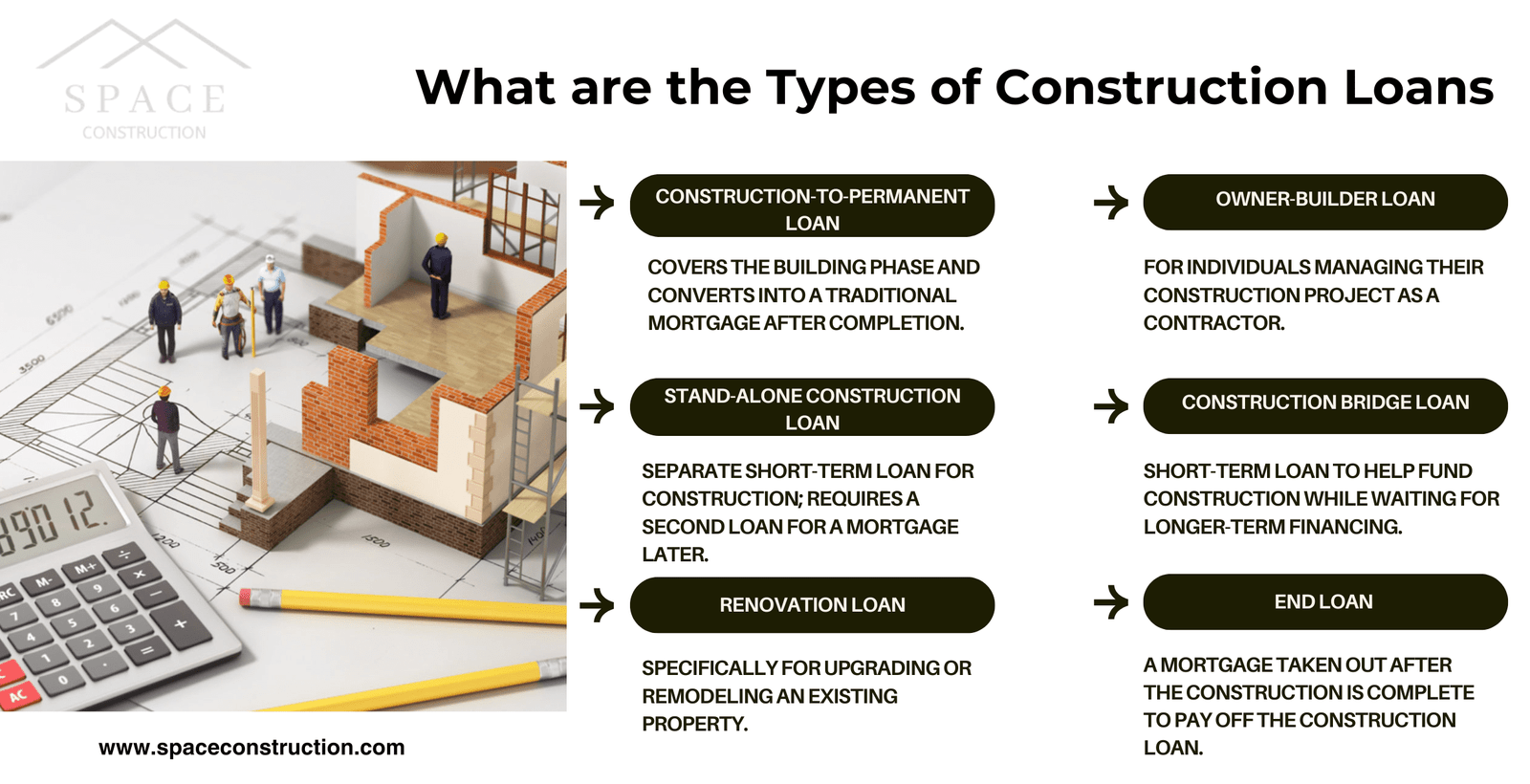

Types of Construction Loans

1. Construction-to-Permanent Loans

Construction-to-permanent loans transition into permanent mortgages once the construction is complete. This type of loan offers the convenience of a single loan application process, which simplifies the borrowing experience. Once the construction phase ends, the loan becomes a traditional mortgage, with regular monthly payments beginning immediately.

2. Stand-Alone Construction Loans

Stand-alone construction loans are separate from the permanent mortgage, which means you’ll need to secure two different loans: one for the construction phase and another for the mortgage once the house is completed. While this can offer more flexibility, it may also involve additional costs and complexities.

3. Construction Home Loans/Construction Financing Loans

These are ideal for homeowners planning to renovate or expand their existing homes. Whether you’re adding a room or updating outdated systems, pairing it with home renovation services in Flower Mound can make the process seamless and efficient.

How to Get a Construction Loan? / New Home Construction Financing

1. Prepare Your Financial Documents

How to get a construction loan? Before applying for a house building loan, ensure that all your new construction financing documents are in order including your credit score, income statements, tax returns, and details about your current debts and assets. Lenders will closely scrutinize your financial stability and creditworthiness to determine your eligibility.

2. Choose a Reputable Builder

Lenders require that you work with a licensed and experienced builder. Selecting a reputable builder, like Space Construction can greatly improve your chances of getting approved for home-building loans. A well-established builder ensures your project will be completed on time and within budget.

3. Develop a Detailed Construction Plan

Now, how does a building loan work? A detailed construction plan is important for securing a loan. This plan should include detailed blueprints, a project timeline, and a budget outlining all costs associated with the construction. Lenders need this information to assess the feasibility of your project and the amount of financing required.

4. Apply for the Loan

Once you have your financial documents, builder, and construction plan, it’s time to apply for the loan. Submit your application to multiple lenders to compare terms and interest rates. Be prepared for a thorough review process, including appraisals, credit checks, and potentially providing additional documentation.

5. Manage the Loan Disbursements

After approval, manage the disbursement of funds according to the draw schedule. Keep track of expenses and ensure that each phase of construction is completed before requesting the next draw. This careful management is vital to maintaining the flow of funds and keeping your loan for the construction of the building on track.

Construction Loans vs. Traditional Mortgages

Construction Loan vs. Mortgage

Let’s look at a simpler breakdown of construction loans vs. mortgages. A traditional mortgage provides a lump sum upfront, which you repay over time with fixed monthly payments. In contrast, a construction loan offers funds in stages and typically has a higher interest rate due to the increased risk involved. Once construction is complete, the loan may convert into a traditional mortgage or require refinancing.

If you’re still deciding between renovation and a new build, consider reading Reasons to Choose a New Construction Home for valuable insights.

Construction Mortgage Loan

A construction mortgage loan combines the features of a construction loan and a traditional mortgage; it begins as a construction loan and transitions into a permanent mortgage once the project is finished; this seamless transition can save time and money, making it a popular choice for many borrowers.

Benefits of Construction Loans

Benefits of Construction Loans

1. Customization

Construction loans provide the flexibility to customize your home to your exact specifications. From the layout and design to the choice of materials, you have control over every aspect of the building process.

2. Incremental Funding

With funds disbursed in stages, you only pay interest on the amount used, potentially lowering overall borrowing costs. This incremental funding also helps manage the budget more effectively.

3. Increased Property Value

Building new or renovating strategically can boost your home’s value, especially when paired with expert home remodeling and restoration in Allen services.

Conclusion

Securing a new home construction loan can be the key to turning your dream into reality. With the right financial preparation and a trusted builder like Space Construction., you can navigate this process smoothly and confidently.

Whether you’re starting from scratch or enhancing your existing property, understanding your financing options is crucial. Combine that with proper timing as discussed in Best Time of Year for Home Remodeling and your project can stay efficient, profitable, and stress-free.

FAQs

1. What is a construction loan?

A construction loan is a short-term, high-interest loan used to finance the building of a new home or significant renovation projects. It covers costs like land, labor, materials, and permits.

2. How does a construction loan work?

Construction loans are disbursed in stages as the project progresses, known as a “draw schedule.” Funds are released after completing specific phases, ensuring the project stays on track financially.

3. What are the types of construction loans?

The main types are Construction-to-Permanent Loans, Stand-Alone Construction Loans, and Construction Home Loans, each catering to different needs, such as converting to a mortgage or financing home improvements.

4. How can I get a construction loan?

To secure a construction loan, prepare your financial documents, choose a reputable builder, develop a detailed construction plan, apply to multiple lenders, and manage the loan disbursements carefully.

5. What is the difference between a construction loan and a mortgage?

A traditional mortgage provides a lump sum upfront, while a construction loan disburses funds in stages. Construction loans typically have higher interest rates and are designed for new builds or major renovations.

Space Construction is a premier Dallas construction company specializing in home remodeling, commercial construction, home additions, kitchen and bathroom renovations, custom builds, and restoration services. Our expert team is dedicated to delivering high-quality craftsmanship, timely project completion, and exceptional customer satisfaction. Whether you need a full remodel, room addition, or commercial build-out, Space Construction provides reliable, professional solutions customized to your vision. Contact us today for a free consultation and let us bring your construction project to life!

0 Comments